The Calm Before the Storm

September 3, 2024

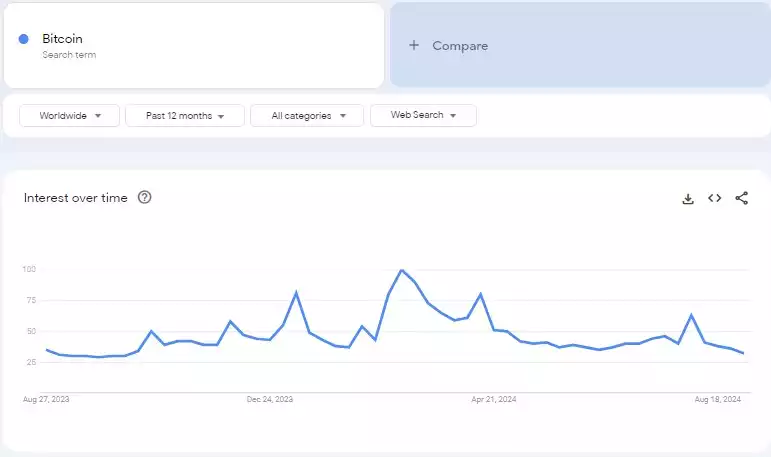

With six months of sideways chop – between US$49,500 and US$74,000 – mainstream interest in Bitcoin has all but disappeared – since the euphoria peaked (with the price) in March of this year.

Google searches experienced a 62% drop since March.

But how long can the quiet period last – and what comes next?

First, let’s look at some objective observations, to decipher where we sit in the bigger picture. Bitcoins macro 50% level of this bull run (so far) sits at US$44,700. August’s monthly candle closed at US$58,800 – marking the 6th consecutive monthly close for Bitcoin above the macro 50% level.

Why is this 50% level significant?

WD Gann’s 50% retracement rule (which has been stress-tested over 120 years) states that – after an initial, sustained price move – prices retrace to 50% of that move. While an asset consolidates after a sustained move up, it can consolidate down to the 50% level of this run while maintaining an objectively bullish structure.

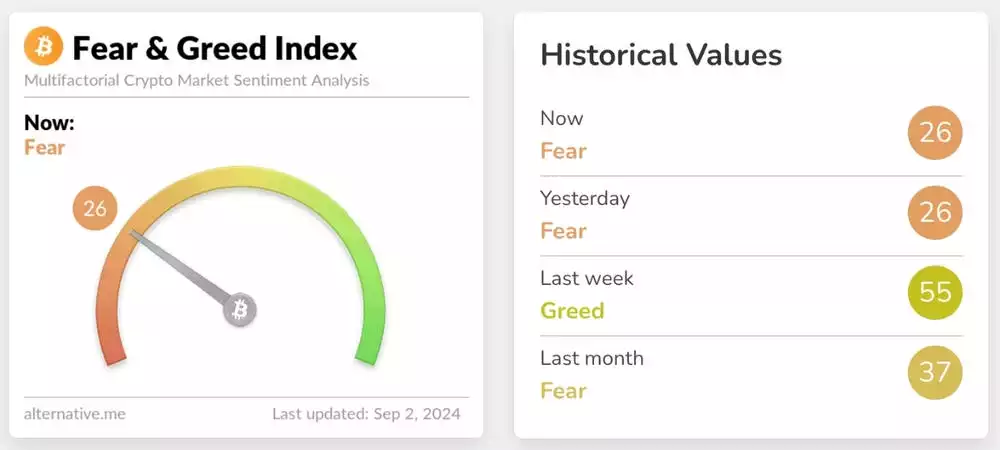

Long-term price closes above this 50% level signal strength in the macrostructure – with long-term price closes below this 50% level signalling weakness. With every long-term price close above the macro 50% level signalling further strength – having 6 consecutive monthly closes well above the macro 50% level – shows significant technical strength for the bitcoin price. Furthermore, while the macro bullish structure remains objectively intact – sentiment has been getting progressively worse over these 6 months.

This divergence, of negative market sentiment with a positive technical structure – is the perfect setup for a bullish storm, quietly brewing, while the masses lose interest.

So when does the calm end and the storm begin?

Zooming into the consolidation range itself – the 50% mark within this six month range of US$49,500 to US$74,000 is – at US$61,700.

With Bitcoin currently below the 50% mark of the 6-month consolidation range – we observe short-term weakness – signalling the need for further sideways and possibly lower prices. However, this structure could suddenly change – if we observe weekly closes above US$61,000. Bitcoin is not giving up the bullish fight at $61.7k, and the bears will be in trouble if the price breaks and holds above this level. Looking at the bigger picture – we don’t think this quiet period will last much longer – let’s break down why.

The “wall of worry” – are we nearly above it?

The “wall of worry” is a term used to describe the period in financial markets where price continues to ascend, in the midst of a variety of negative factors. Climbing the “wall of worry” is always a confusing phase for market participants, with fears left and right, everything feels like the end of the world, and participants expect prices to crash – however, markets keep going up.

Since the bottom of 2022, we have faced the Silicon Valley banking crisis, the U.S. debt ceiling fears, recession fears, attempted assassinations, WWIII fears, and most recently – extreme fear, with the yen carry trade unwinding.

None of these have affected the macro price structure and have caused short-term volatility. Notice how the “Japanese Yen Carried Trade” extreme fear has disappeared already? Most participants might not even remember the emotions around the U.S. debt ceiling or the Silicon Valley banking crisis of last year. However, the fear around these events was extreme at the time. With Bitcoin consolidating around the peak of the previous bull run – it might be that the wall of worry is nearly behind us.

What’s the macro economy looking like?

Central banks around the world are moving towards liquidity injections and easy monetary policy.

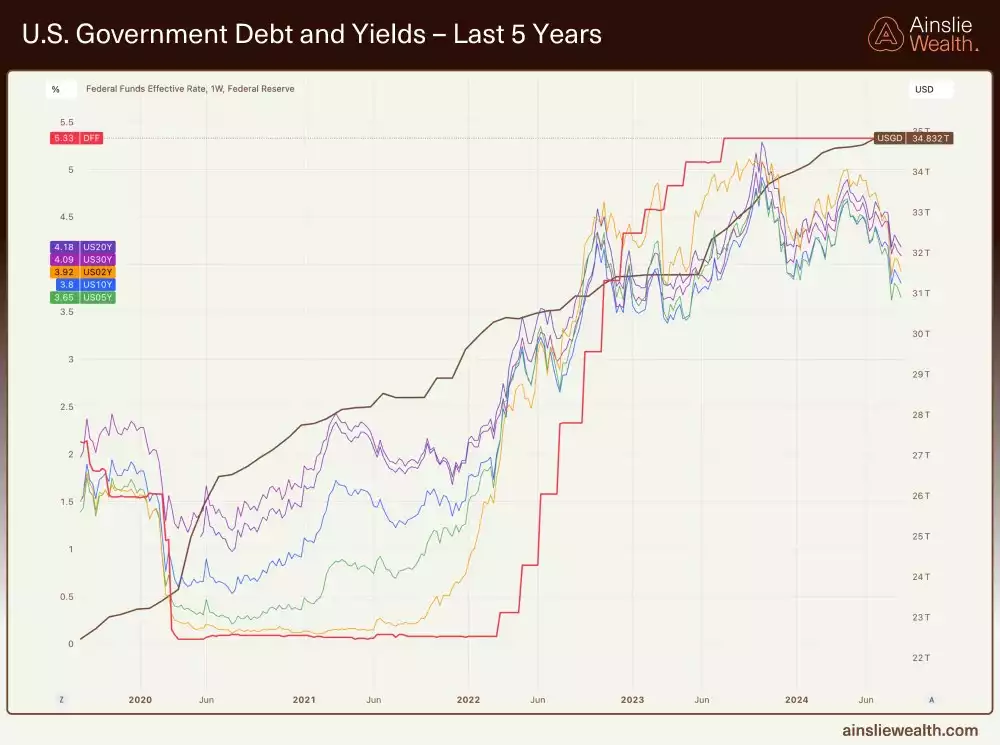

- The U.S. Bond markets, the biggest and “smartest” money in the world – have historically front-run the US Fed’s interest rate policy. With bond yields falling off – the big players are signalling rate cuts coming soon.

- To back this up, the U.S. Fed Powell adopted a decisively dovish tone in his recent annual address at Jackson Hole – saying the “time has come” to reduce interest rates.

- Central banks in the UK, Eurozone and Asia are already cutting interest rates – paving the way for the U.S. to follow – in today’s globalised economy, Central banks tend to move policy in tandem.

- The second largest central bank – the People’s Bank of China – has recently injected large amounts of stimulative liquidity – this is expected to continue as it has entered an annual seasonal phase of easy monetary policy – in the second half of the year.

Lower bond yields will result in higher bond values. With banks holding massive amounts of U.S. bonds, their collateral holdings increase in value – increasing their overall lending capacity. Additionally with lower interest rates borrowers are also able to service larger amounts of debt. This dynamic injects additional liquidity into the system – further driving speculation and leverage into risk assets.

Finally, with lower interest rates and bond yields – investors are encouraged to move capital away from the U.S. dollar to seek returns elsewhere – moving liquidity flows towards alternate investments. Therefore, looking forward at the macro economic picture – we can expect a flood of liquidity, leverage and speculation. This overlays perfectly from a timing perspective on the final phase (coined “winner’s curse” phase) of the 18.6-year economic cycle – which we are currently scheduled to be on the lookout for. This phase of the macro cycle is typical of leverage, liquidity and valuations increasing exponentially – explained in depth here.

All of this, while the masses aren’t paying attention.

While it is never wise to try and board a moving train – in markets it seems that most wait for the train to start moving, before scrambling to board it all at once – further causing exponential price increases and heightened emotions in the masses. So while most find this consolidation phase boring – we prefer to make the most of this calm, to be well set up – for the storm to follow.

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.