Crypto in Your SMSF: Key Considerations

August 13, 2024

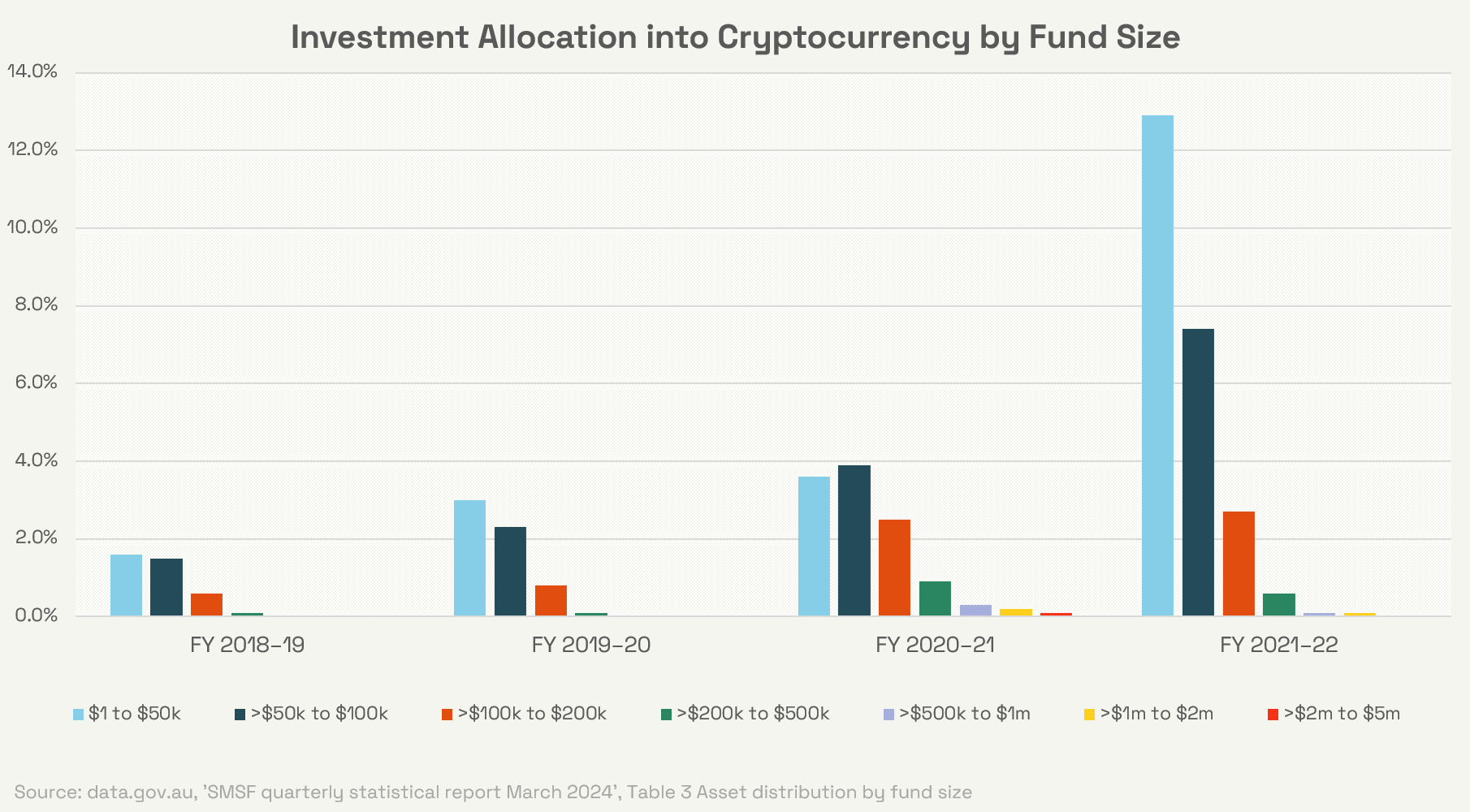

The 2024 financial year saw a near-record number of new Self-Managed Superannuation Fund (SMSF) establishments across several quarters, with 7,836 set up in the September 2023 quarter and 7,371 in the March 2024 quarter. Many of these funds are being created to gain exposure to cryptocurrency as investment narratives gain traction and traditional APRA-regulated funds continue to refuse members access to this asset class. Key factors driving investor interest include the Bitcoin halving in April 2024, which has historically preceded strong Bitcoin rallies, the launch of Bitcoin and Ethereum ETFs in the US by major global asset managers like BlackRock, which has alleviated regulatory concerns, and the anticipation of interest rate cuts, which typically favour risk-on assets like technology stocks and cryptocurrencies.

Mat Merlehan, who oversees SMSFs at Tax On Chain, a specialised accounting firm focusing on cryptocurrency and digital assets, has observed substantial new interest from investors wanting to gain exposure to cryptocurrency through their superannuation. Mat says many view this as an opportunity to capitalise on what they believe to be the start of a new market cycle.

Tax On Chain offers tax and SMSF compliance, forensic accounting, and virtual CFO services tailored to clients in the crypto ecosystem. With their team’s expertise in the cryptocurrency landscape and growing interest from investors seeking to gain exposure to crypto through their superannuation, this article provides valuable insights from Tax On Chain on how to effectively and safely navigate the volatile cryptocurrency markets. Investing in cryptocurrency within a SMSF offers exciting opportunities but comes with significant responsibilities and risks. As digital assets gain traction as a viable investment class, it’s crucial for SMSF trustees to be well-informed about the intricacies of holding crypto. This article explores key considerations for potential investors, covering the importance of understanding the volatile nature of crypto markets, the need for regulatory compliance within SMSFs, and the steps to protect yourself from scams.

What to Consider Before Investing in Crypto

High Risk Tolerance and Volatility: Investing in cryptocurrency demands a high-risk tolerance, as the market is known for its extreme volatility. Prices can swing dramatically in short periods, and investors need to be prepared this volatility so they can remain level-headed and avoid making impulsive decisions.

Understanding Your Investment: Understanding what you’re investing in is crucial so that you have conviction in your choices and investment thesis. This conviction will be invaluable in helping you weather extreme volatility and avoiding panic selling. Moreover, having a deep understanding of your investments also equips you with the knowledge to identify potential scams. By recognising red flags and conducting due diligence, you can protect yourself from fraudulent schemes that prey on uninformed investors.

Use Reputable Exchanges: Opt for reputable crypto exchanges, particularly Australian ones, as they adhere to higher regulatory standards. This can provide added security and assurance that your transactions are handled properly, and assets stored securely.

Self-Custody Safety: If you decide to hold your own crypto, ensure you know how to do so securely. Self-custody requires careful management of private keys and understanding the risks involved, including the potential for loss or theft.

Avoid FOMO: Don’t let the fear of missing out (FOMO) drive investment decisions. Chasing after assets that have already seen significant price appreciation can lead to significant losses. Stay disciplined and avoid impulsive decisions.

Be Patient: It’s worth remembering that money invested through superannuation generally cannot be accessed until retirement age, which is currently between 60 and 65 years of age. Because of this, time horizons for investments in SMSFs tend to be substantially longer compared to personal portfolios. As such, patience is key in cryptocurrency investing. Investors who adopt a simple buy-and-hold strategy tend to outperform those trying to trade based on short-term market movements. Long-term investment tends to yield better results in the volatile crypto space. It also results in substantially lower costs for the administration of the SMSF.

Key Compliance Considerations When Holding Crypto in an SMSF

Trust Deed Compliance: Before investing in cryptocurrency, ensure that your SMSF’s trust deed allows for investments in digital assets. Many SMSFs were established before cryptocurrency became mainstream, so the deed may need to be updated to permit such investments.

Investment Strategy Inclusion: Cryptocurrency must form part of your SMSF’s investment strategy. An SMSF investment strategy is a plan that outlines the fund’s investment objectives and how these will be achieved. It must consider factors like risk, return, diversification, and liquidity. Ensuring crypto aligns with these objectives is crucial for regulatory compliance.

Liquidity Considerations: SMSF assets must be valued at market rates as of June 30 each year. Ensure that your crypto investments have sufficient liquidity to justify a market value. Illiquid assets like NFTs and digital art can pose challenges in meeting these valuation requirements.

Proper Documentation for Self-Custody: If you choose to self-custody crypto assets within your SMSF, ensure all wallets designated for the SMSF are properly attributed to the fund through formal documentation and resolutions. This helps in maintaining clear ownership and compliance.

Avoid Commingling of Assets: Commingling of private and SMSF crypto assets is strictly prohibited. Separate exchange accounts and private wallets must be maintained solely for the SMSF, ensuring clear delineation between personal and fund assets. This is essential to meet regulatory standards and avoid potential legal issues and penalties.

Use Exchanges with High Reporting Standards: It’s essential to use cryptocurrency exchanges that adhere to high reporting standards. These platforms offer transparency and accuracy in transaction reporting, which is crucial for verifying and accounting for your SMSF’s crypto transactions. Proper documentation is vital for meeting regulatory requirements and ensuring that all transactions are accurately reflected in your fund’s financial records. This not only aids in compliance but also simplifies the auditing process and helps maintain the integrity of your SMSF.

Engage Professionals Who Understand Cryptocurrency: Working with accountants and auditors who understand the crypto landscape and have expertise in navigating its complexities will help keep your compliance costs down. Relying on traditional accountants with little experience in cryptocurrency can lead to excessive accounting fees, as they may charge you for the additional time spent learning how to property account for and verify your crypto transactions. This “on the job learning” can be costly and may still may not provide accurate results.

Cryptocurrency Scams: Avoid Becoming a Victim

Protecting yourself from cryptocurrency scams is crucial in today’s digital landscape. Scammers often target vulnerable investors who have limited understanding of digital assets with promises of high returns, exploiting the allure of cryptocurrency. To safeguard yourself, it’s essential to conduct thorough research before making any investments. Ensure the platforms or services you use are reputable and regulated, as this reduces the risk of fraud. Look for warning signs such as unsolicited offers, pressure to invest quickly, and overly complex or obscure investments.

Engaging professionals who are knowledgeable about the cryptocurrency market is another vital step. These experts can help you navigate the complexities of crypto investments, ensuring compliance with regulatory standards and minimising the risk of falling prey to scams. Scammers often exploit a lack of understanding, so having a knowledgeable team can be a strong defence.

Additionally, it’s important to maintain a sceptical mindset when evaluating investment opportunities. Offers that seem too good to be true, particularly those promising guaranteed returns, should be approached with caution. Verify any claims made by doing independent research and seeking advice from trusted professionals.

You can find more detailed information regarding common red flags to look out for on Tax On Chain’s website here.

Closing remarks

As the popularity of cryptocurrency continues to grow, more investors are exploring the potential benefits of including digital assets in their SMSFs. However, this comes with its own set of challenges and risks. Navigating the volatile crypto market requires a high-risk tolerance, a strong investment thesis, and careful compliance with SMSF regulations. By using reputable exchanges, avoiding common pitfalls, and seeking guidance from professionals who specialise in crypto, investors can better position themselves to capitalise on the opportunities while mitigating risks. Ultimately, informed and strategic decision-making is key to safely and effectively managing cryptocurrency investments within an SMSF.

If you are interested in Tax On Chain’s specialised crypto services, you can contact the team directly via their website https://taxonchain.io

Share this Article:

Crypto in your SMSF

Top Movers

Get Started Trading Crypto with Ainslie.

Join Thousands of satisfied customers who trust Ainslie for their cryptocurrency and bullion needs.