Bitcoin Analysis: Beyond the Block – August 2025

Posted on 14/08/2025 | 499 Views

Today the Ainslie Research team brings you the latest monthly update on Bitcoin – including the Macro fundamentals, market and on-chain technical metrics and all of the other factors currently driving its adoption and price. This summary highlights some of the key charts that were discussed and analysed by our expert panel. We encourage you to watch the video of the presentation in full here for the detailed explanations. Bitcoin and Global Liquidity.

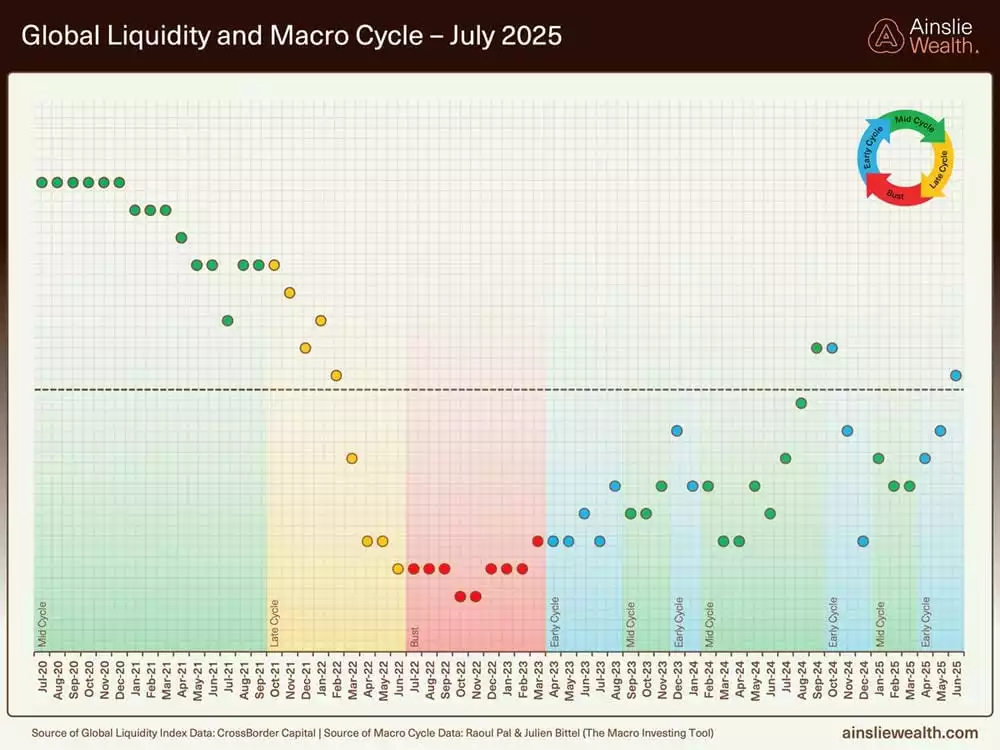

Bitcoin and Global Liquidity

Bitcoin is the most directly correlated asset to global liquidity. Trading Bitcoin is effectively trading the global liquidity cycle, but with an adoption curve that delivers significantly higher highs and lows each round. We aim to buy during the 'Bust' phase or liquidity lows, and rotate out during the 'Late Cycle' when liquidity is overextended and downside protection is warranted—our preference is to rotate into gold. With the right timing and structure, this approach can significantly outperform the impact of ongoing monetary debasement. The Bitcoin cycle low was in November 2022, and since then, its performance has outpaced all other major assets..

Where are we currently in the Global Macro Cycle?

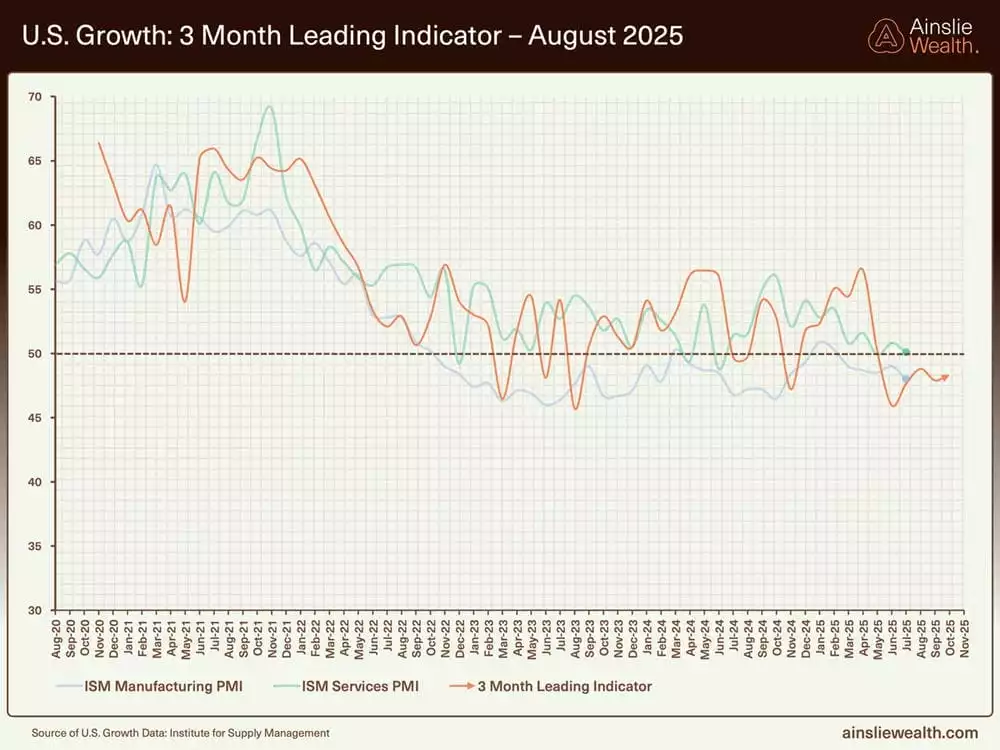

Welcome to the August edition of Beyond the Block. Our position within the global macro cycle and liquidity environment has not materially shifted since last month. We continue to believe that a sluggish global economy with lower inflation presents a supportive backdrop for risk assets. Policymakers have little incentive to cut fiscal support or impose true austerity, and central banks remain cautious about tightening or accelerating balance sheet contraction. In fact, many are cutting rates despite inflation remaining above target—more on that shortly.

In July, services kept the global recovery intact, with the US again leading. Strong inflows into tech, banking, and insurance drove activity and new orders to fresh highs, reinforcing a services-led recovery narrative. Manufacturing, however, retraced earlier gains as the temporary boost from tariff front-loading faded and new trade policies applied pressure. The takeaway: persistent strength in US services is counterbalancing manufacturing weakness, shifting the growth engine for mid-2025.

Looking ahead, the AI build-out is reshaping global growth beyond just US tech. In the US, it's spurring high-value manufacturing, job creation, and regional revivals as states compete to host the next AI hub. Globally, supply chains are adjusting, capital is crossing borders, and economies from Asia to Europe are aligning with the AI infrastructure surge. This rapid expansion is boosting productivity and setting the pace for the next phase of global growth, with the US at the forefront.

With capital pouring into energy, semiconductors, and data centre infrastructure, we believe we are witnessing the early stages of a new digital-industrial cycle.

Central Banks: Policy Shift in Motion

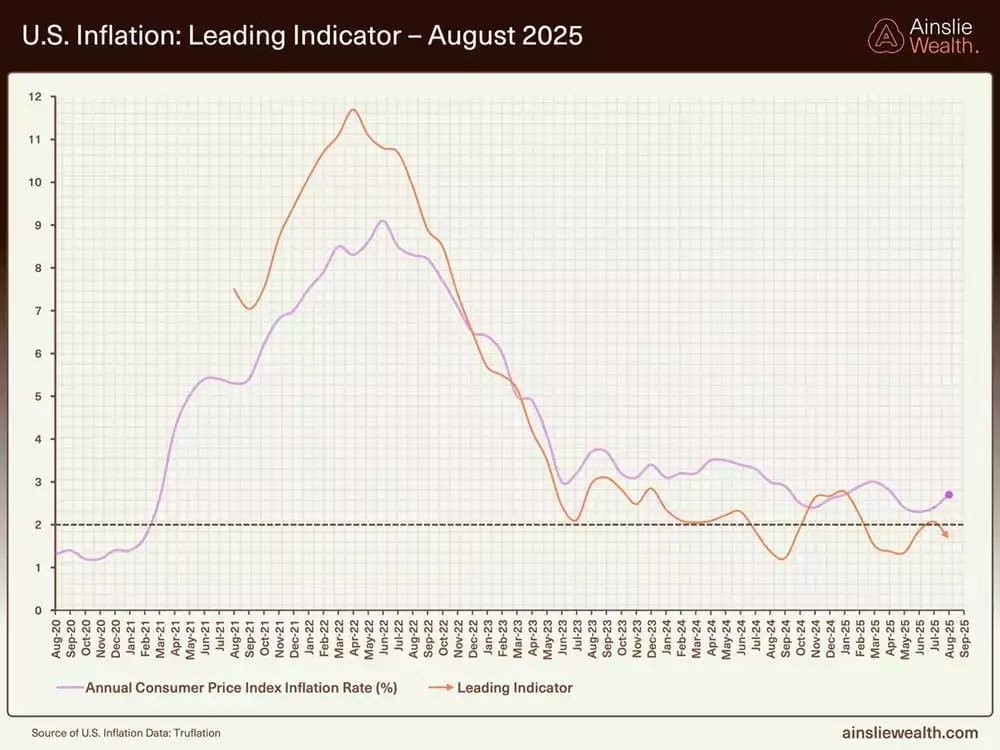

We’ve long argued that central banks quietly accept "a bit of inflation" to help governments erode debt burdens. Their actions confirm it: rates are falling even with inflation above target. The US, UK, RBA, and ECB are all softening policy. After almost two years of "higher for longer," the risks have flipped. Slowing growth, weaker labour markets, and tighter credit now outweigh the push to bring inflation to target.

In the US, the Fed is expected to cut rates again in September, with a 94% probability, even as inflation remains just above 2%. Officials cite softening demand and tepid job growth as reasons for recalibration. The Bank of England has already cut rates with inflation still at 3–3.5%, citing growth concerns. Similarly, the ECB eased despite headline inflation remaining above target, anticipating disinflation without waiting for perfection.

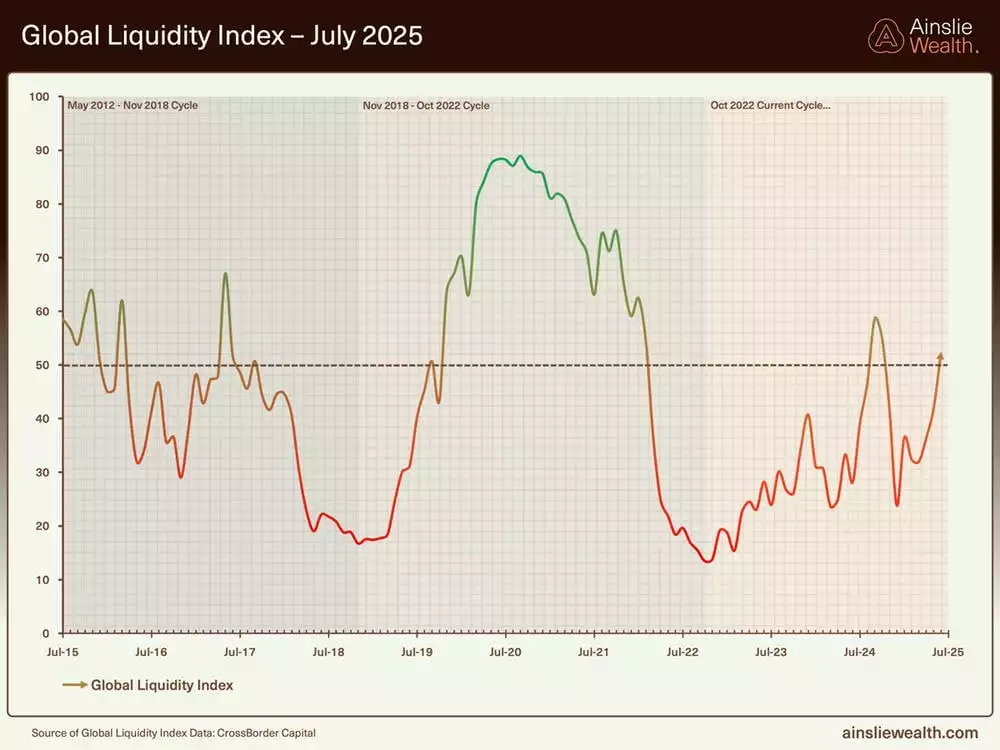

Where are we currently in the Global Liquidity Cycle?

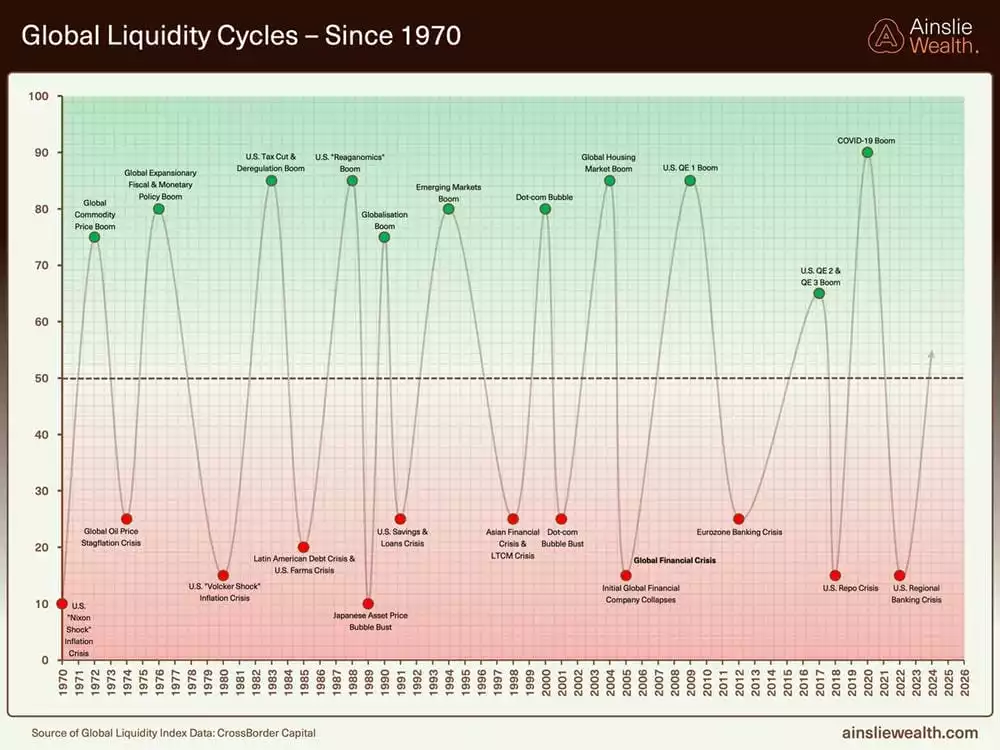

A look at liquidity cycles since 1970 shows their clear influence on financial markets. Scarce liquidity can lead to currency, banking, and financial crises, while abundant liquidity drives asset booms.

Governments and central banks attempt to smooth the cycle by injecting liquidity during downturns and withdrawing it during booms. In our view, they often miss the mark—but this creates opportunity, particularly for assets like Bitcoin.

Since the 2022 cycle bottom, central bank liquidity has moved in a choppy pattern. Policy consistency has been elusive.

Short-term, the US Treasury is conducting one of its largest cash refills in years, issuing a wave of short-term bills to rebuild the TGA, draining liquidity in the process. Every dollar raised comes from the banking system, pulling from money markets, deposits, and the Fed's RRP facility. While demand for bills remains strong, this still acts as a near-term headwind.

Once the TGA hits its $850 billion target (likely by late September), Treasury spending will resume, releasing liquidity back into markets. Short-term pressure will then flip to a liquidity tailwind, lifting asset markets into the end of 2025..

The 12-month rate of change in global liquidity confirms the trend—choppy but gradually rising since 2022, now up 7% year-over-year, with room for further upside.

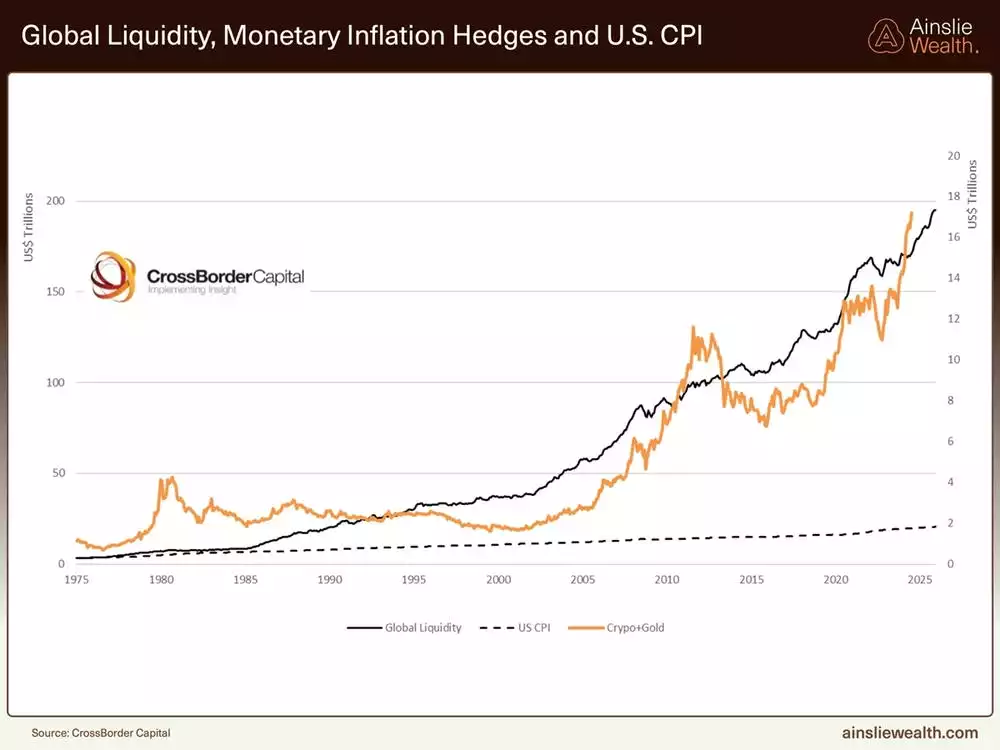

Real Assets in a Liquidity-Driven World

In an era dominated by fiscal policy, owning real assets is essential. Asset prices—including crypto, gold, and equities—move in step with global liquidity, not CPI. Capital injections by central banks push asset prices higher long before inflation appears in official data.

CPI tracks a basket of consumer goods, but it’s a lagging and incomplete gauge of true monetary inflation. Real expansion happens in balance sheets, money, and credit—flowing first into assets, not groceries. While inflation might appear subdued, liquidity is inflating anything scarce: equities, real estate, gold, and Bitcoin.

Holding cash in this environment puts you on the wrong side of the equation. Liquidity chases assets, and that's where wealth compounds. Owning scarce assets isn’t just about defence—it’s the smartest offence in a policy-driven cycle.

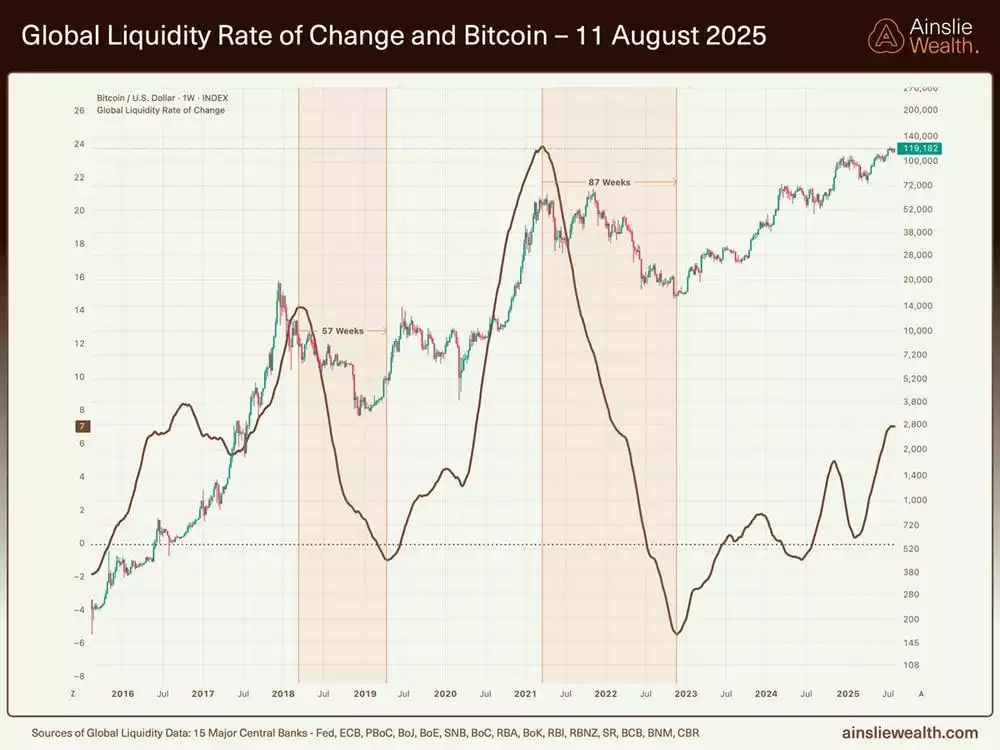

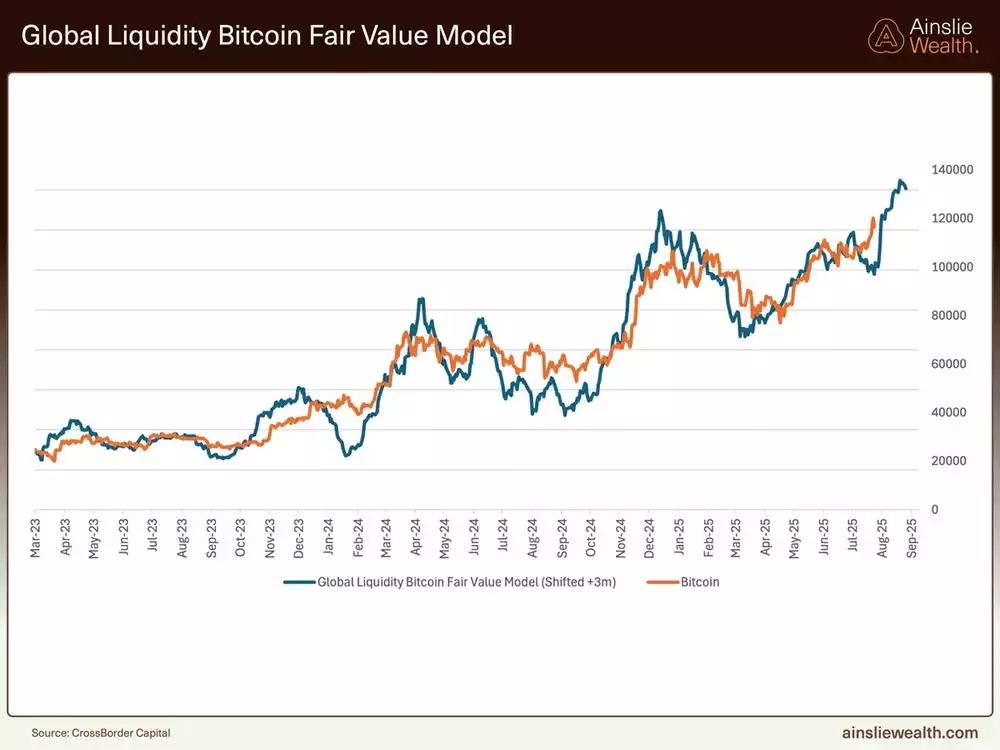

Bitcoin and the Liquidity Link

Bitcoin is a direct play on global liquidity. Unlike M2, which largely reflects retail money, the Global Liquidity Index captures central bank money, bank credit, and cross-border flows. It maps closely to Bitcoin's fair value. Expansions in liquidity drive Bitcoin higher (with a typical lag), while contractions cap gains or trigger declines.

Understanding capital flows is central to understanding the Bitcoin cycle. Track liquidity, and you’re tracking Bitcoin’s real driver.

Investing in Bitcoin’s long-term adoption

This month, US 401(k) plans were cleared to invest directly in Bitcoin and digital assets. With over $8.9 trillion in 401(k)s, this paves the way for billions to flow into the space. It marks the first step in embedding Bitcoin within mainstream US retirement systems.

Plans - August 2025.jpg?ver=XbLAmq6C42vTh_SyJyUWJg%3d%3d)

Even as mainstream adoption gains traction through ETFs, 401(k) plans and listed treasury holdings, Bitcoin uptake still lags its potential, with institutional scepticism proving persistent. Regulatory clearance for 401(k) exposure is a milestone, but most plan sponsors are treading carefully, and many gatekeepers remain hesitant. Vanguard, the world’s second-largest asset manager, continues to block direct Bitcoin or crypto access on its platforms—keeping millions of everyday savers on the sidelines.

Spot Bitcoin ETFs are posting record inflows, yet several of the largest wirehouses and RIAs restrict access or underweight digital assets in their models. Treasury adoption makes headlines but remains the exception rather than the rule; most listed companies still classify BTC as a “risk asset” rather than a balance-sheet essential. We remain early in Bitcoin’s journey, with a long path between early adoption and full mainstream saturation.

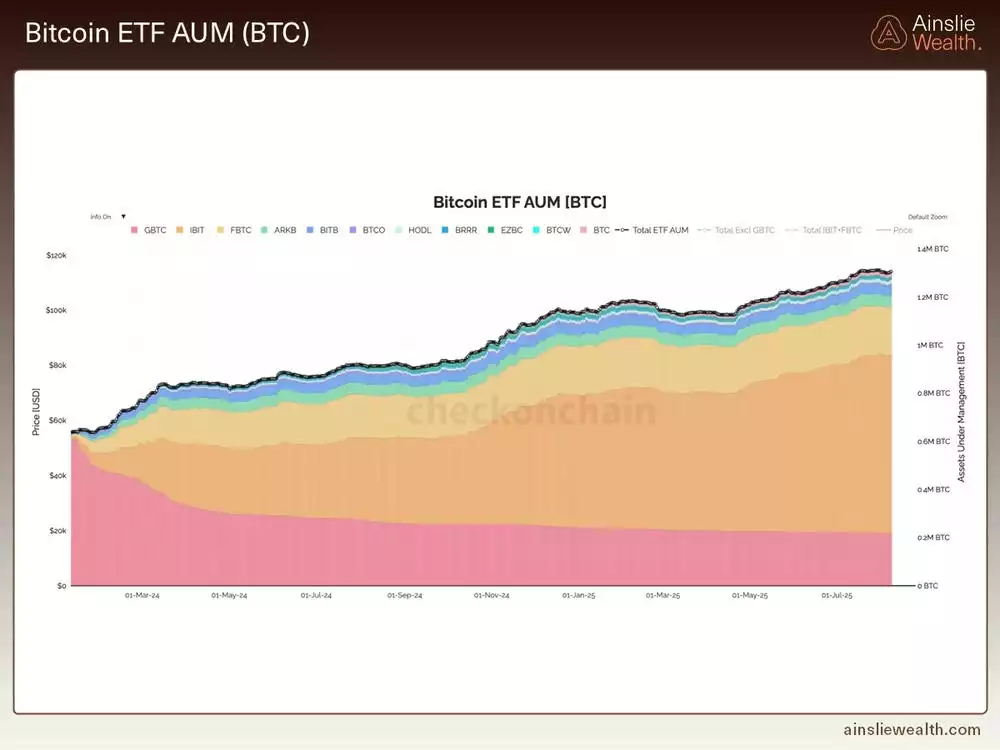

The drop to $112,000 earlier this month coincided with nearly US$1 billion flowing out of US spot Bitcoin ETFs in just a week. On 2 August alone, US$812 million was redeemed—the second-largest daily outflow since launch—driven by sizeable withdrawals from Fidelity’s FBTC and ARK’s ARKB. Once prices stabilised, flows reversed quickly, with sidelined capital returning alongside the rebound. It’s a clear reminder that in the ETF era, sentiment and capital flows can pivot in days.

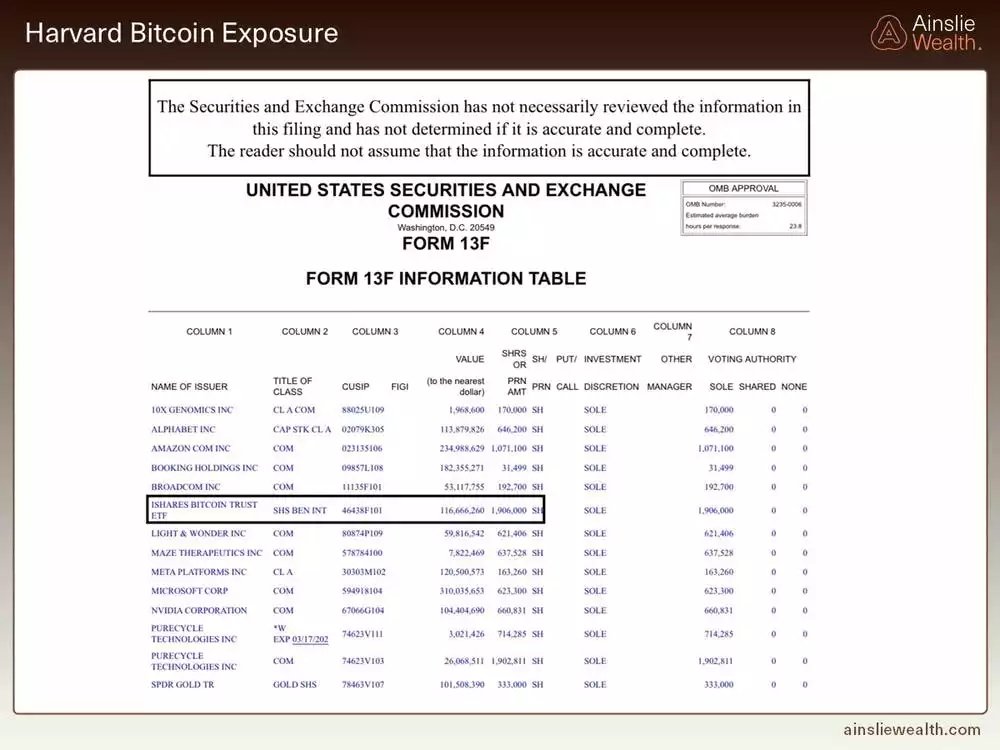

Harvard’s US$116 million allocation to IBIT is eye-catching, but also telling. While IBIT is now among the top five holdings in Harvard’s 13F, it represents just 0.22% of the university’s endowment—a rounding error for the world’s wealthiest academic fund. The signal is clear: large institutions are participating, but still in test-the-waters mode, firmly within the ‘early adopters’ phase.

As discussed previously, CPI inflation and asset inflation are very different forces. Wages are typically indexed to CPI, whereas asset values respond to global liquidity—which continues to grow strongly. The inflation-adjusted performance of the S&P 500 since the US left the gold standard, versus inflation-adjusted median income, illustrates how the end of fiscal discipline coincided with an era of sustained asset price expansion.

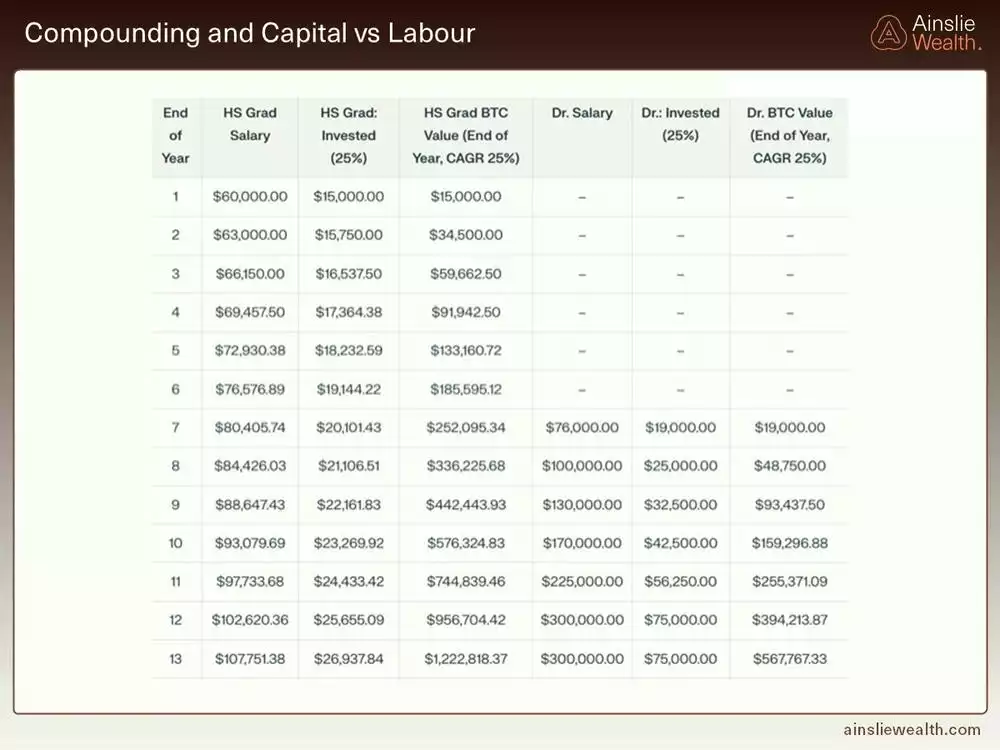

The next chart is a comparative case study showing Bitcoin’s compounding effect over a long-term horizon.

When investing, time is your most valuable ally. While philosophical debates about timing will continue, the data is clear: if your aim is financial independence, nothing is more powerful than starting early and letting compounding work. A disciplined high-school graduate can build a sizeable portfolio before a graduate professional earns their first wage. Higher salaries help, but lost compounding years are rarely recoverable. Whether it’s Bitcoin or another asset, time in the market almost always beats timing the market.

For our example, Bitcoin compounds at 25% annually over 13 years—less than half its five-year average of ~60%—with both investors allocating 25% of gross income each year. The school-leaver starts on $60k with 5% annual wage growth, living at home until 24 to boost early savings. The GP earns nothing for 12 years before starting on a higher salary, with student debt excluded from the calculation. The result underlines the enduring advantage of compounding and early participation.

Conclusion

Central banks are cutting rates into what could prove one of the strongest business-cycle tailwinds in a generation. AI investment is accelerating, sparking manufacturing growth, job creation and a broader industrial revival—yet policymakers are easing into this digital expansion. The Fed, Bank of England, RBA and ECB have all pivoted, cutting rates while inflation remains above target. The policy focus has shifted from squeezing out the last of inflation to cushioning slowdown risks and supporting the real economy.

Bitcoin is benefiting from both its own adoption cycle and a backdrop of rising global liquidity. The coming period may be remembered as Bitcoin’s ‘institutional adoption’ moment, when cyclical and structural forces align to deliver outsized rewards for those who build conviction and stick to their plan.

“Courage is in much shorter supply than genius” - Peter Thiel

Watch the full presentation with detailed explanations and discussion on our YouTube Channel here:

Until we return with more analysis next month, keep stacking those sats!

Joseph Brombal

Research and Analysis Manager

The Ainslie Group

x.com/Packin_Sats