2023 in Review: A Transformative Year for Digital Assets

Posted on 21/12/2023 | 2213 Views

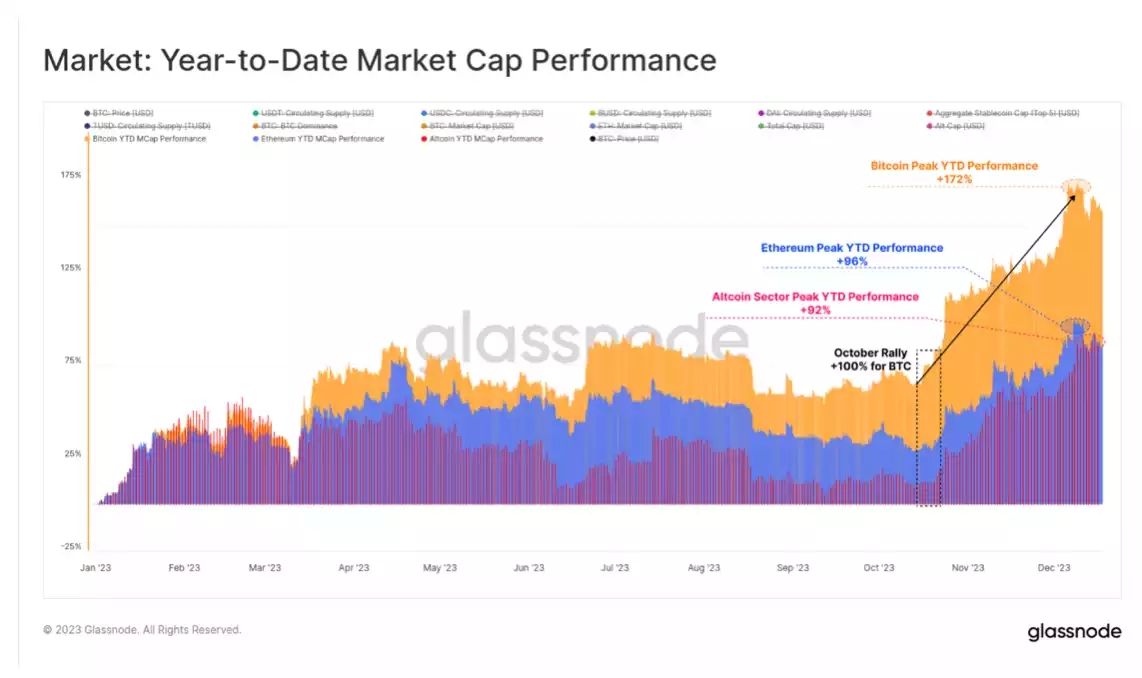

In 2023, the digital asset landscape experienced a remarkable year marked by substantial growth. Bitcoin led the charge with a staggering increase of over 172%, demonstrating remarkable resilience with corrections staying below the 20% mark. This year also witnessed significant net capital inflows into major players like BTC, ETH, and various stablecoins, with October standing out as a crucial month for institutional capital entering the market.

Long-term holders of Bitcoin are now holding a near-all-time high percentage of the total supply, indicating strong conviction in the asset. A substantial majority of Bitcoin is currently held in profit, reflecting the asset's robust performance throughout the year. In the broader market, Tether reasserted its dominance in the stablecoin sector, while CME futures trading volumes surpassed those of even the largest of crypto exchanges. The options market within digital assets also saw remarkable growth, highlighting the sector's expanding complexity and investor interest.

Bitcoin's market dominance notably increased; a trend often seen in recovery phases following bear markets. Meanwhile, Ethereum displayed slower relative growth, despite successful network updates and expansion within its Layer 2 ecosystem. The ETH/BTC Ratio dipped to multi-year lows around 0.052, even considering Ethereum's Shanghai update. In a broader context, digital assets significantly outshined traditional assets such as equities and bonds throughout the year. A major chunk of the year's gains occurred post-October, with the rally breaking above US$30k and surpassing other critical pricing levels, setting a new tone for the digital asset market.

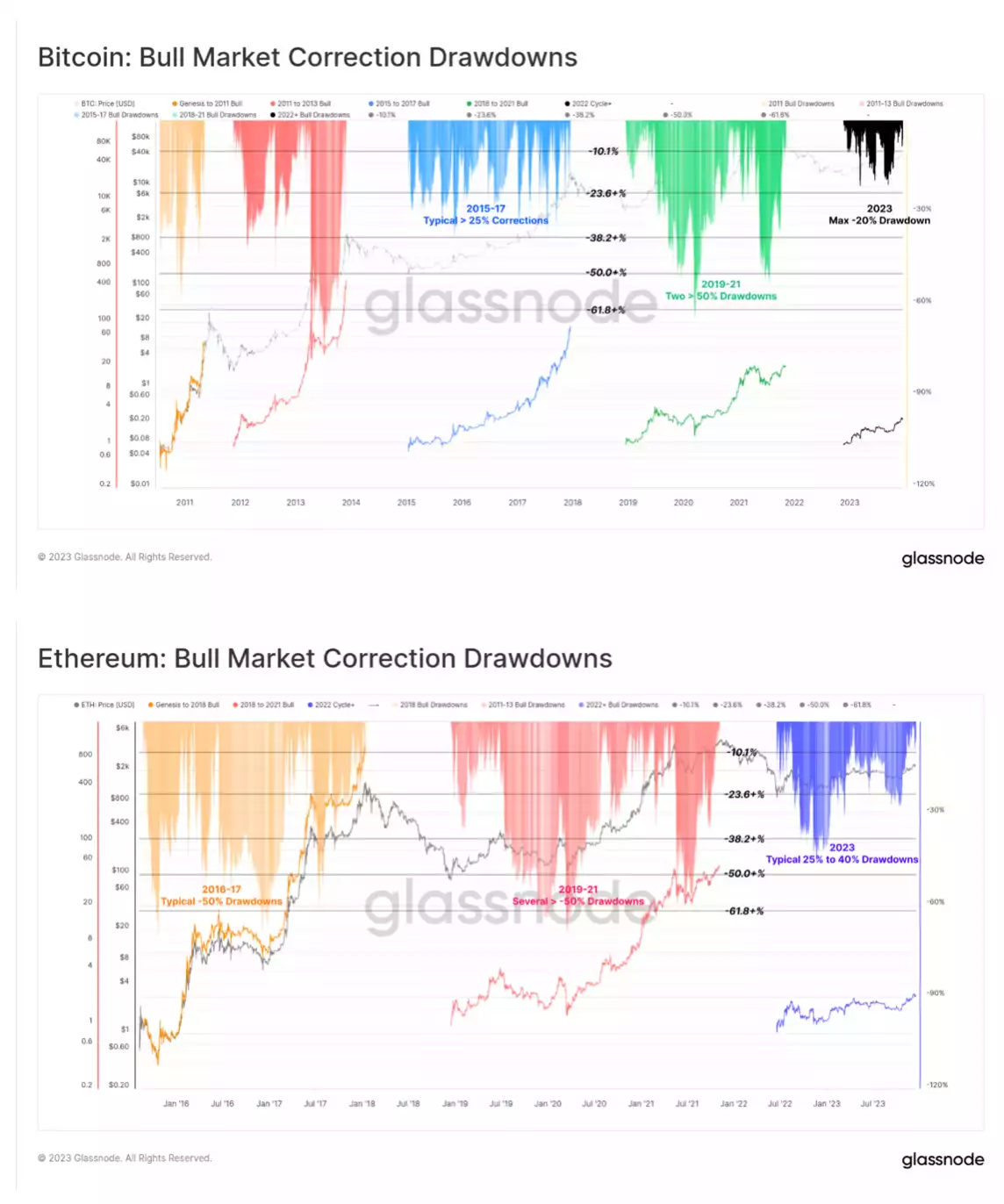

The 2023 digital asset market has distinguished itself with notably shallow price pullbacks and corrections, marking a departure from past trends. Typically, bear market recoveries and bull market uptrends for Bitcoin have witnessed pullbacks of at least -25%, and frequently even more than -50%. However, this year has been different for Bitcoin, with the deepest correction only reaching -20% below its local high. This pattern indicates strong buy-side support and a balanced supply-demand dynamic, underscoring the market's resilience throughout the year.

Ethereum's performance in 2023 mirrors this trend of shallower corrections. Its most significant dip was around -40% in early January. Despite lagging slightly behind Bitcoin in terms of growth, Ethereum's market has remained constructive. This is particularly noteworthy considering the reduced supply issuance following the Merge and continued strong demand flows. Ethereum's steady performance, in the context of these market dynamics, reflects the sustained confidence and interest in this leading digital asset.

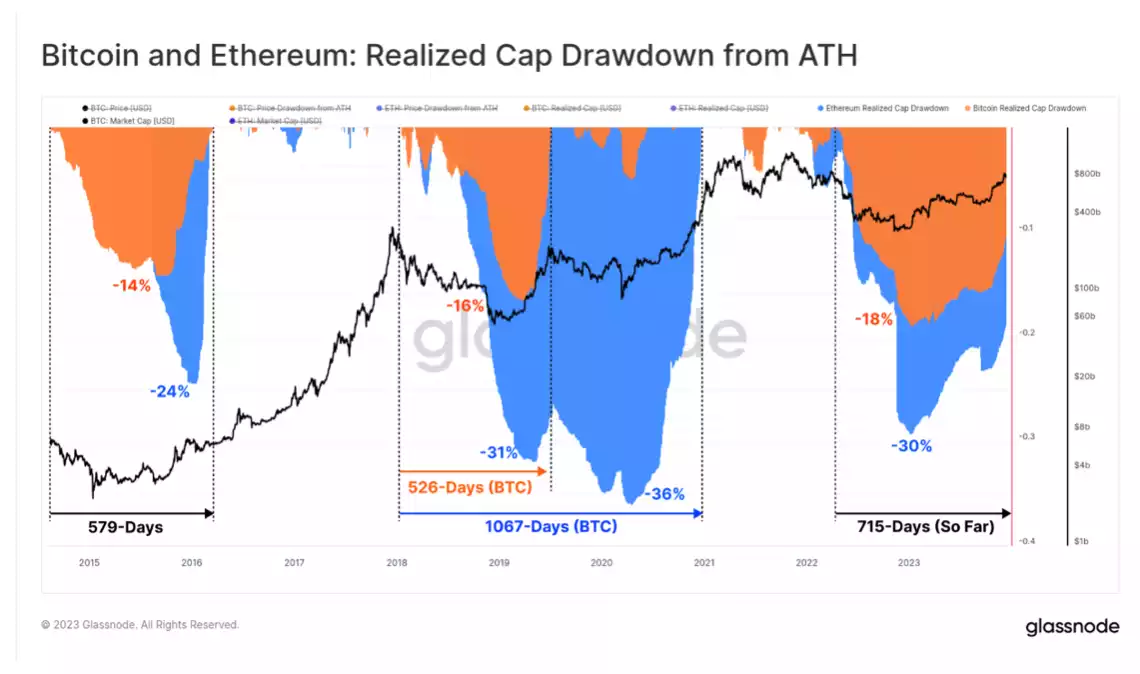

The Realised Cap, an on-chain metric for both Bitcoin (BTC) and Ethereum (ETH), gauges the recovery of capital flows in these assets. In the 2022 bear market, this metric experienced significant drawdowns, aligning with patterns seen in previous cycles. Specifically, there was a net capital outflow of -18% for Bitcoin and -30% for Ethereum, indicating the extent of the market downturn.

However, the current cycle is witnessing a somewhat slower recuperation in terms of capital inflows. For instance, Bitcoin's Realised Cap reached it's All-Time High (ATH) over 715 days ago, whereas, in past cycles, this recovery typically occurred within approximately 550 days. This elongated recovery period highlights a more gradual yet steady inflow of capital back into these major digital assets. Despite the slower pace, this consistent recovery trend underscores a resilient and maturing market environment.

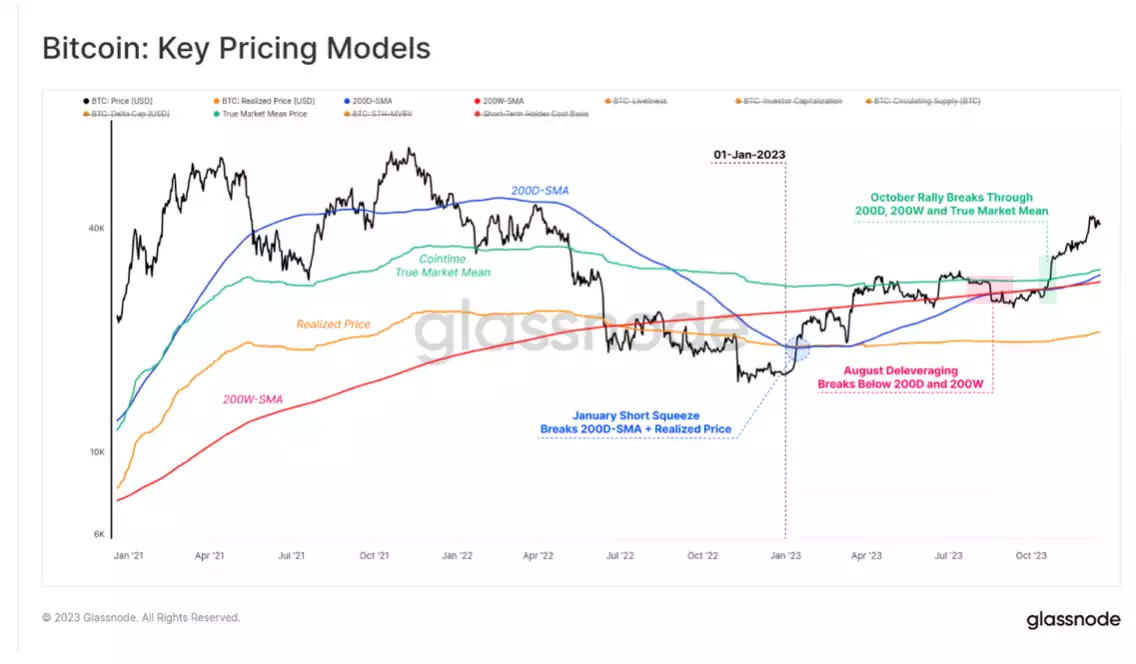

The year began with a bullish tone as a short squeeze in January propelled Bitcoin above its Realised Price (in orange in the chart below), a level that had capped its price since June 2022. Following this breakthrough, Bitcoin faced and overcame resistance at the 200-day Simple Moving Average (200D-SMA - blue), eventually encountering the 200-week SMA (200W-SMA - red) in March.

A notable period of consolidation ensued between the 200D-SMA (blue) and the True Market Mean Price (green). This phase extended until August, marking one of Bitcoin's least volatile periods in recent memory. However, a sharp deleveraging event later caused a dramatic drop from US$29k to US$26k in just one day, temporarily pushing Bitcoin below these key technical averages.

October brought a significant rally, marking a pivotal moment in Bitcoin's year. The cryptocurrency not only rebounded but also successfully breached the crucial US$30k psychological barrier, navigating through all remaining price models. This rally led Bitcoin to a yearly high of US$44.5k, and currently, the market is witnessing Bitcoin's attempts to surpass this high after a week of consolidation.

Reflecting on the digital asset landscape, 2023 has emerged as a year of significant recovery and resurgence, a sharp departure from the challenges and downtrends experienced in 2022. This year marked a renewed and growing interest in digital assets, resulting in notable outperformance across the market.

A key development in 2023 was the introduction of Inscriptions on Bitcoin, adding an innovative layer to on-chain activities and potentially reshaping the way we interact with Bitcoin's blockchain. Meanwhile, Bitcoin's supply dynamics have shown a marked predominance of Long-Term Holders. This trend points to a strong holding sentiment within the investor community, bolstering confidence in the asset. Moreover, the majority of Bitcoin investors are currently in profit, reflecting the favourable market conditions that have prevailed throughout the year.

Looking ahead, there's a palpable sense of anticipation around significant market catalysts. The prospect of a U.S.-based Bitcoin ETF, expected to launch in early 2024, is gaining traction and could significantly impact the market. Additionally, the upcoming Bitcoin halving event scheduled for April stands as a pivotal moment, poised to influence Bitcoin's market dynamics potentially.

Combining these factors, the outlook for the coming year appears both exciting and bullish for Bitcoin and the digital asset sector at large. These developments suggest a continuing upward trajectory, offering promising opportunities for investors and enthusiasts in the digital asset space.

About Ainslie Crypto:

Considering securing your cryptocurrency trading, purchasing, or exchanging strategies? Join us here or connect with Ainslie Crypto's team at 1800 AINSLIE or via [email protected]. We offer dedicated, personalised ‘human to human’ assistance to ensure the seamless, secure integration of cryptocurrency into your portfolio, whether for personal investment, business strategy, or your Self-Managed Super Fund (SMSF). Ainslie have been a trusted dealer and custody provider for Gold 1.0 for 50 years and bring the same service to Gold 2.0, Bitcoin, since 2017.

In an era where traditional banking systems impose increasing limitations, Ainslie Crypto offers a forward-thinking payment solution with our Australian Digital Dollar (AUDD) platform. Developed by Novatti, AUDD allows you to navigate beyond the constraints of conventional financial systems, offering stability, security, and ease in your crypto transactions.

Unchain yourself on-chain.

Want to swap directly between bullion and crypto? Ainslie seamlessly provide swaps between these two hard assets.

At Ainslie, our commitment extends beyond just transactions. We specialise in providing secure digital wealth protection. Our robust crypto custody services are backed by rigorous, real-time internal audits, ensuring your investments are not only secure but also managed with the highest standard of care and expertise. You can always see your own segregated wallet address and balance, value and trade history. Trust Ainslie Crypto to be your partner in navigating the dynamic world of digital assets, where we blend human insight with advanced technology to deliver a service that stands apart in the industry.